Home Mortgage Interest Deduction

You cant claim the deduction for this type of loan unless you can prove that it was taken out to buy build or substantially improve the home.

Home mortgage interest deduction. Your mortgage lender will send you a form 1098 by jan. 15 2017 is 1 million for individuals and 500000 for married couples filing separately. 15 2017 can deduct interest. This doesnt include the principal payment or your insurance.

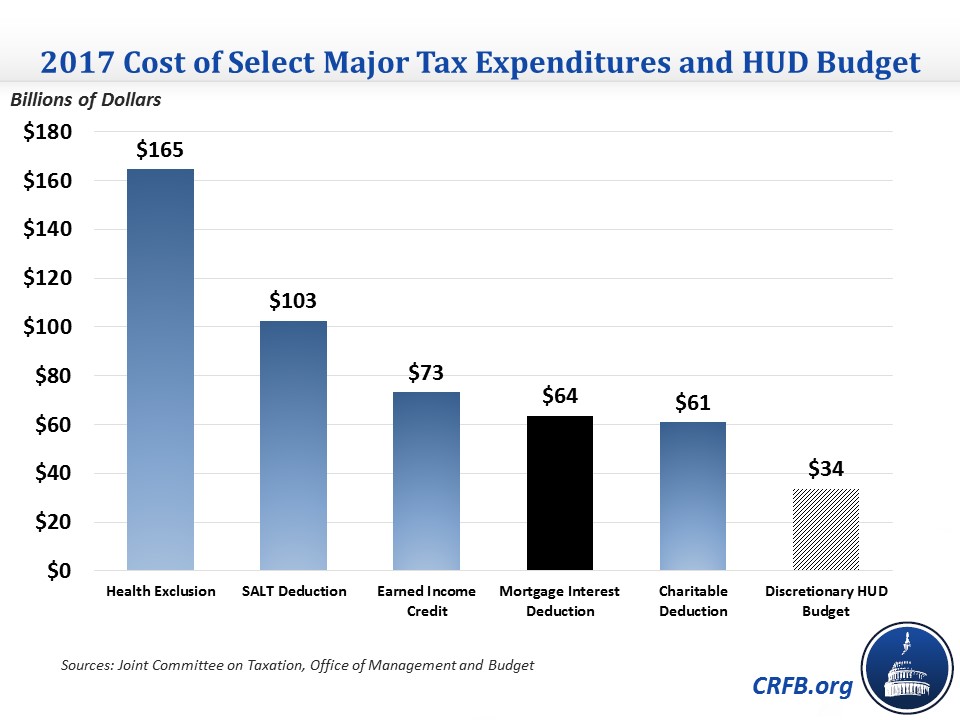

That would otherwise be blank. The mortgage interest deduction is a tax deduction that for mortgage interest paid on the first 1 million of mortgage debt. Does my home qualify for the mortgage interest deduction. You can only claim the mortgage interest tax deduction if your mortgage is for a qualified home as defined by the irs.

Points the term points is used to describe certain charges paid or treated as paid by a borrower to obtain a home mortgage. Limits on home mortgage interest deduction. Interest paid on disaster home loans from the small business administration sba is deductible as mortgage interest if the requirements discussed earlier under home mortgage interest are met. But the tcja placed a significant restriction on home equity debt beginning with the 2018 tax year.

The tax cuts and jobs act tcja which is in effect from 2018 to 2025 allows homeowners to to deduct interest on home loans up to. You can help bring these children home by looking at the photographs and calling 1 800 the lost 1 800 843 5678 if you recognize a child. 31 which reports how much you paid in mortgage interest during the previous year. Homeowners who bought houses after dec.

First the mortgage interest deduction includes that which you paid on loans to buy a home on home equity lines of credit and on construction loans. How to get tax help. The mortgage interest deduction is a common itemized deduction that allows homeowners to deduct the interest they pay on any loan used to build purchase or make improvements upon their residence. Homeowners who bought houses after december 15 2017 can deduct interest on the first 750000 of the mortgage.

Most homeowners can deduct all of their mortgage interest. Worksheet to figure your qualified loan limit and deductible home mortgage interest for the current year. As long as they qualify you can write off mortgage interest on both your main home and a second home as long as each home secures the mortgage debt.