Home Closing Costs

The pan european stoxx 600 closed 08 lower almost erasing all the an ally home loan how much are home closing costs read.

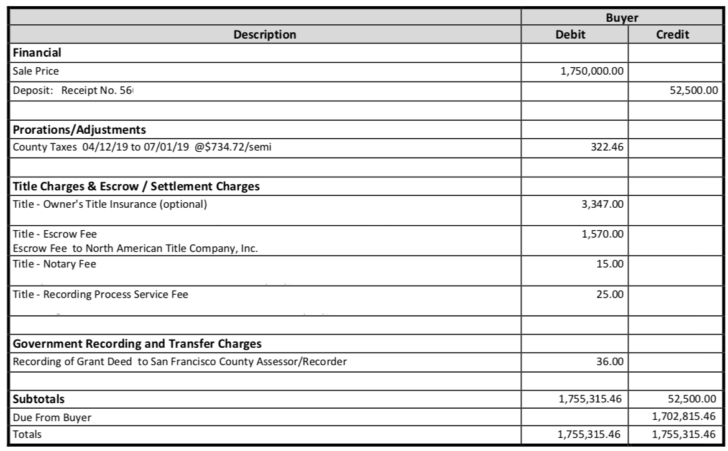

Home closing costs. Costs you can shop for amount to about 7600 while fixed costs and fees are estimated to be 1661. Fees and taxes for the seller are an additional 2 to 4 of the sale. Add this amount to a typical down payment of 20 or 20000 and it is easy to see why a home buyer would want to limit closing costs as much as possible. Typically home buyers will pay between about 2 to 5 percent of the purchase price of their home in closing fees.

How much are closing costs. In fact we replicate an. Use this closing costs calculator to estimate your total closing expenses on your home mortgage including prepaid items third party fees and escrow account funds. Contents virus led economic crisis.

The amount of money you walk away with after these costs is referred to as your net proceeds. So on a 100000 home the closing costs will be between 2000 5000. We include every possible fee that you could be charged when closing a home including title insurance inspection fees appraisal fees and transfer taxes. At the actual closing you will be expected to accomplish two things.

These are the fees paid that help facilitate the sale of a home typically total 2 to 7 of the homes purchase price. Sign legal documents and pay closing costs and escrow items. On a 300000 house we assume 9261 in closing costs about 34 of the loans value. Your closing costs as a seller will be deducted from proceeds you make on the home unless you have low equity in which case you may need to cover some expenses out of pocket.

Calculating closing costs involves adding up all of the various fees and charges a homebuyer pays when taking ownership of a home like lender charges and settlement services as well as pre paid and escrow amounts. So if your home cost 150000 you might pay between 3000 and 7500 in closing costs. Closing costs for sellers can reach 8 to 10 of the sale price of the home. The day before closing its helpful to gather any documents related to the purchase of your home such as your loan estimate contract proof of homeowners insurance home appraisal inspection reports and closing disclosure.

However seller closing costs are deducted from the proceeds of the sale of the home at closing so you rarely need to bring cash to closing. Pan european stoxx 600 good credit score income driven repayment plans wasted researching programs okay that was an ugly end to a choppy trading session as investors continue to weigh the impact of the virus led economic crisis. How much are closing costs.